Should You Invest in the NASDAQ Composite (.IXIC)? Weighing the Pros and Cons

Introduction

You know the NASDAQ as the tech-heavy stock exchange, home to many of the world’s most innovative companies. As an investor, you’ve probably wondered whether you should put your money into an index fund that tracks the NASDAQ Composite (.IXIC). On the one hand, the NASDAQ has a history of high returns. The tech sector powers much of our economic growth, and companies listed on the NASDAQ are at the forefront of that. But the NASDAQ is also more volatile. When the tech bubble burst in 2000, the NASDAQ lost over 60% of its value. More recently, the NASDAQ dropped over 30% during the early stages of the 2020 market crash.

So should you invest in the NASDAQ Composite? There are good arguments on both sides. In this article, we’ll break down the pros and cons so you can make an informed decision about whether the NASDAQ Composite is the right investment for your portfolio.

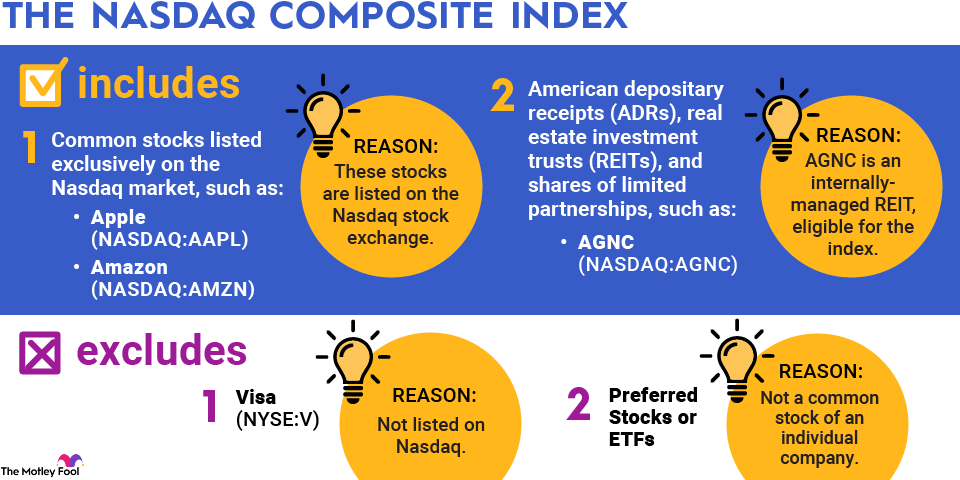

What Is the NASDAQ Composite Index (.IXIC)?

The NASDAQ Composite Index (.IXIC) is a stock market index that includes over 3,000 companies listed on the NASDAQ stock exchange, most of which are technology and biotech companies. It’s a broad measure of the performance of tech stocks.

Should you invest in the Nasdaq Composite? Here are some pros and cons to consider:

Pros:

- Exposure to innovative tech companies. The Nasdaq is dominated by big tech names like Apple, Amazon, and Google as well as emerging growth companies. Investing in the Nasdaq gives you exposure to the tech sector’s potential for high growth.

- Historically solid returns. Over the long run, the Nasdaq has generated strong returns, outpacing the S&P 500. From 1995 to 2020, the Nasdaq saw annualized returns of over 9% compared to about 7% for the S&P 500.

Cons:

- Higher volatility. Because tech stocks are often high-growth, the Nasdaq tends to be more volatile. It fell over 70% during the dot-com crash of 2000-2002 and over 50% during the financial crisis of 2007-2009. The higher volatility means higher risk.

- Narrow sector focus. With its heavy tech focus, the Nasdaq is less diversified than broader indexes. If the tech sector struggles, it will significantly impact the Nasdaq’s performance.

- Valuation concerns. Some analysts argue that tech stocks have become overvalued in recent years. If there is a major tech sell-off, the Nasdaq could be particularly hard hit.

In summary, the Nasdaq Composite provides exposure to the tech sector’s growth potential but also comes with higher volatility and risk. For investors seeking tech exposure, the Nasdaq can be a good option as part of a balanced portfolio. But make sure you fully understand the risks.

The Pros of Investing in the NASDAQ Composite

If you’re looking to invest in an index that tracks some of the largest tech companies, the NASDAQ Composite (.IXIC) could be a great choice. Here are some of the pros of investing in this popular index:

The NASDAQ Composite includes over 3,000 stocks, so you get broad exposure to the tech sector. This means your money is spread out over many companies, reducing risk. The index includes major players like Apple, Microsoft, Amazon, Facebook, and Google – companies that are innovating and poised for growth.

Historically, the NASDAQ Composite has seen higher returns than other indexes. Over the last 10 years, it has returned over 230%! While past performance doesn’t guarantee future returns, the tech sector continues to thrive.

The companies in the NASDAQ are industry leaders and often considered the “disruptors.” They are creating new technologies that change the way we live and work. Investing in the NASDAQ Composite gives you exposure to artificial intelligence, cloud computing, streaming media, and more – innovations that are shaping the future.

The NASDAQ Composite is a liquid index, meaning it’s easy to buy and sell. You have many options to invest, including index funds, ETFs, and futures. This makes it ideal if you want to get in and out of positions quickly.

While the NASDAQ does come with risks like volatility, for many investors the potential rewards outweigh the risks. If you believe in technology and innovation, the NASDAQ Composite could be a great way to invest in the future.

The Cons of Investing in the NASDAQ Composite

The NASDAQ Composite index certainly has some downsides to consider before investing.

Volatility

The NASDAQ is a highly volatile index, meaning it tends to fluctuate sharply in value. Tech companies, especially smaller startups, often experience big price swings based on product announcements, earnings reports, and other news. If you have a low risk tolerance, the volatility of the NASDAQ could make for an uncomfortable ride. The value of your investments could drop substantially in a short period of time.

Speculation

The NASDAQ is home to many speculative tech companies that have promising technologies or products but are not yet profitable. Investing in these speculative companies is very risky, as many will fail completely. It’s difficult to pick the long-term winners, so you could end up losing money on speculative bets.

Overvaluation

Tech companies are often highly valued, sometimes beyond their actual worth or financial metrics. This means NASDAQ stocks may be overpriced, leading to lower future returns. If the hype around certain technologies or companies fades, it could significantly impact the NASDAQ. Many dot-com companies were overvalued before the tech crash of the early 2000s, for example.

Limited diversification

The NASDAQ only includes tech companies, so it lacks the diversification of broader market indexes. Your investments are concentrated in one sector, so you’re highly dependent on the performance of tech stocks. If the tech sector declines, it will likely drag down the NASDAQ and your portfolio. For the best balance, you need exposure to other sectors like healthcare, finance, and consumer goods.

While the growth potential of the NASDAQ is appealing, make sure you go in with eyes open to the risks. The volatility, speculation, overvaluation, and lack of diversification mean the NASDAQ should only make up part of a balanced portfolio. By understanding both the pros and cons, you can invest in the NASDAQ judiciously and avoid getting burned.

Top NASDAQ Composite Stocks to Consider

The NASDAQ Composite contains some of the hottest tech stocks. If you want exposure to innovative companies, here are some of the top stocks in the index to consider:

Apple (AAPL)

Apple is the largest company in the NASDAQ Composite and a tech leader. It makes popular products like the iPhone, iPad, Mac computers, and Apple Watch. Apple has a strong brand, loyal customer base, and continues to push the envelope with new innovations.

Microsoft (MSFT)

Microsoft develops software like Windows and Office used by billions of people worldwide. It also provides cloud services, gaming, and other products. Microsoft is a stable, established company that provides steady growth and income.

Amazon (AMZN)

Amazon is an e-commerce giant that sells just about everything online and provides digital streaming services. It has a fast-growing cloud computing business called Amazon Web Services that powers many websites and apps. Amazon continues to expand into new areas like healthcare and groceries.

Google (Alphabet) (GOOG, GOOGL)

Google is the dominant internet search engine and advertising platform. It provides popular services such as Gmail, YouTube, Google Maps, and Google Home smart speakers. Google benefits from people’s constant need for information and has many growth opportunities in areas like cloud services, AI, and more.

Facebook (FB)

Facebook operates the world’s largest social media network with over 2 billion users. It makes money through advertising that is targeted based on users’ personal data and information. Although facing some controversy over data privacy issues, Facebook is still growing and innovating. It owns other popular platforms like Instagram, WhatsApp, and Messenger.

The NASDAQ Composite contains strong, innovative companies in fast-growing industries. Buying and holding the major players in this index could boost your portfolio’s long term returns. However, technology stocks are often volatile, so make sure to diversify and be prepared for ups and downs.

Tips for Investing in the NASDAQ Composite (.IXIC)

Investing in the NASDAQ Composite (.IXIC) index isn’t for the faint of heart. The tech-heavy index is volatile, but the potential for strong returns over the long run may make it worth the risk. Here are some tips for investing in the NASDAQ Composite:

Diversify Your Portfolio

Don’t put all your eggs in one basket. While tech stocks have driven much of the growth in the NASDAQ, diversifying your holdings across sectors can help reduce risk. Consider allocating only a portion of your portfolio to the NASDAQ Composite.

Invest for the Long Term

The NASDAQ Composite is prone to large price swings, so a long-term investment horizon is key. Don’t panic and sell if the market drops. Over time, the NASDAQ has consistently outperformed the S&P 500. Stay invested for at least 5 to 10 years to ride out short-term volatility.

Choose an Index Fund

Investing in the NASDAQ Composite directly can be complicated and risky. An easier approach is to invest in a NASDAQ index mutual fund or ETF. These provide broad exposure to the index while managing risk. Low-cost funds like the Vanguard NASDAQ Composite Index Fund (VNQ) are good options.

Keep an Eye on Valuations

While the tech sector continues to grow rapidly, stock valuations in the NASDAQ can get overheated. Monitor the price-to-earnings ratios of NASDAQ stocks and the index as a whole. If valuations seem excessively high, it may be better to wait before investing more money in the NASDAQ. Overvalued markets often see sharp pullbacks.

Rebalance Regularly

As tech stocks in the NASDAQ rise and fall, the weighting of your portfolio can get out of balance. Rebalance at least once a year by selling some of your winners and buying more undervalued stocks. This helps ensure you maintain a diverse mix of holdings and don’t end up overly concentrated in a few expensive names. Staying disciplined with rebalancing is key to long-term NASDAQ success.

The NASDAQ Composite offers the potential for market-beating returns thanks to innovative tech companies. But by following some prudent tips for investing, you can pursue those gains while managing risks. With the right strategy and perspective, the NASDAQ Composite can be very rewarding.

Conclusion

So there you have it, the good, the bad and the risky with investing in the NASDAQ. While the potential for strong returns over time is appealing, the volatility means it may not be for the faint of heart. If you can handle the ups and downs and take a long-term view, the NASDAQ could be a solid addition to a well-diversified portfolio. But go in with your eyes open – be prepared for a wild ride. At the end of the day you need to assess your own risk tolerance and investing goals. If you do decide the NASDAQ is right for you, start small and ease into it. Who knows, with patience and perseverance it could pay off big in the long run. But there are no guarantees, so make sure you balance the risks. The choice is yours!